How do I prepare financial reports for QBE insurance

They have started asking for GPFR

QBE are now (as of 2023) making construction businesses submit AASB 1060 / Tier 2 financial reports.

They believe this provides them with assurance of the going concern of the entity.

We have helped many accounting firms meet these demands.

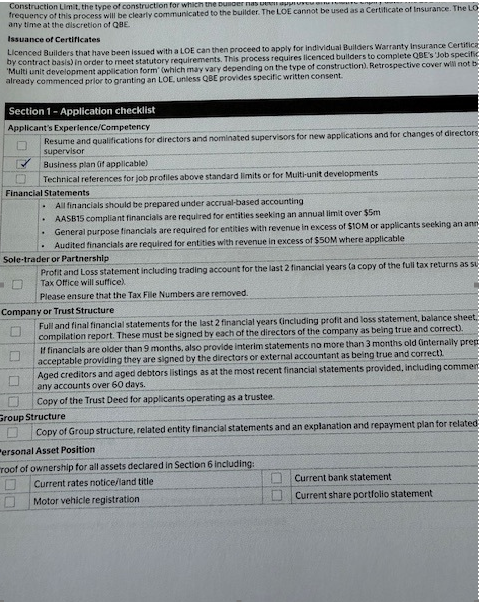

Key thresholds to watch:

- AASB 15 is required for annual limits up to $9.99 million

- AASB 1060 GPFR required for firms with revenue from $10M to $49.99M

- AASB 1060 GPFR Audited needed for firms over $50M in revenue

Example QBE form from a client:

This shift raises important questions:

- Will other insurance companies follow QBE’s lead?

- Will QBE expand this to other industries—such as retail or childcare?